Saving habits in Britain

Britain’s unhealthy attitude towards personal savings could steer us towards an early retirement crisis. Research from the UK’s biggest peer-to-peer (P2P) lender, Zopa, looked at the saving habits in Britain and has found that Brits are in need of a critical financial health check.

What are we saving for?

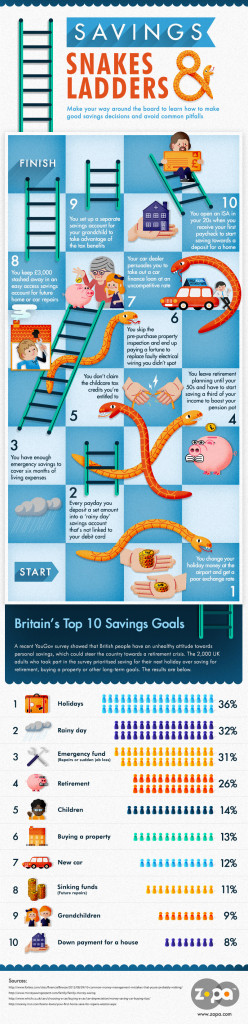

Survey findings from YouGov show that whilst Brits think they have a healthy attitude towards money, when it comes to saving for the future, over a third (36%) prioritize their next holiday rather than the long term.

The survey of over 2,000 UK adults shows that saving for retirement is not considered a top priority. In fact, Brits are still longing for sandy shores and far-off places, with holidays topping the list of what we are saving for. And that’s if you save at all, with 1 in 5 (19%) admitting to having no savings product whatsoever.

Britain’s Top Ten Savings Goals:

- Holiday – 36%

- Rainy day – 32%

- Emergency fund – 31%

- Retirement – 26%

- Children – 14%

- Buying a property – 13%

- New car – 12%

- Future repairs – 11%

- Grandchildren – 9 %

- Down payment for a house – 8 %

How are we saving it?

The majority of Brits still hold their savings in traditional savings accounts (59%) despite rock bottom interest rates being on average 0.66% (according to MoneyFacts.co.uk). To make matters worse, the current rate of inflation stands at just under 3%, meaning savings are wasting away and losing the pounds they have saved.

Whilst 8 out of 10 of us say that we have little or no trust in our savings provider, only two in five (43%) of us actually review our savings once a year or less often, and over half (51%) don’t even know the current rate of interest on our savings accounts.

What about retirement?

Worryingly, when asked what Brits are saving for, retirement came in a lowly fourth and saving for a house deposit came last on the list. Whilst over two thirds (69%) of 18-54 year olds believe that they are good with money, only one in five (21%) are actively saving for their retirement. This is despite 81 per cent admitting that they need to save in order to have a comfortable retirement and avoid a retirement crisis.

Snakes and ladders

Zopa have released an interesting little infographic which captures this information in the form of one of our favourite games – the classic snakes and ladders:

Those are some pretty scary numbers, and unfortunately, things are about the same in the U.S. I shudder to think about how these people plan on feeding themselves when they have no money at retirement time. All of those fancy holidays won’t fill their bellies. 🙁

I am sorry but as a parent, I am reading the numbers with mouth agape. Children at #5? Maybe there is so much provisions for Brit children so that vacation is more a priority?