Following a tough August (UK & US markets falling by around 6-7% in the month), September didn’t treat market investors much better. However, Moneystepper Savings Challenge participants aren’t the kind of people who let something like that get in the way of progress…!

What’s been going on in September?

A couple of big bike rides (including the Wooler Wheel 100km race), and a few PBs set at the “Park Runs” (5km races) meant that September was a pretty healthy month. However, after a glorious week of sunshine here in Newcastle in the last week of September, October has brought winter in with a vengeance!

Financially, nothing to really report in the month. We are looking to buy a new house, but are patiently waiting for the right house, and more importantly at the right price. We missed out on a couple of good properties in September, but both sold for more than we thought that they were worth and hence we aren’t going to worry about that too much.

The September mini-challenge was to read a self-improvement book, and I chose a property investment book. You can find out what I though about it in the linked article. However, I’ve since taken action and will be hosting the inaugural PropertyHub meet-up in my hometown of Newcastle in early November and every month going forward. A nice little networking opportunity!

Financially for the challenge, my results have been as follows:

September Net Worth Goal Pro-Rata (Total) = 22.5% (30%)

September Net Worth Result = 18.7%

September Savings Rate Goal = 35%

September Savings Rate Result = 26%

My net worth fell by 1% point in the month, largely due to the worldwide market continuing to fall in September. The FTSE 100 (UK) fell by 3.0%, the S&P 500 (US) fell by 2.6%, the Nikkei 225 (Japan) fell by 8.0%, the SHCOMP (China) fell by 4.8%, the DAX (Germany) is down 5.8%….you get the picture…

However, as we said last month, this is just expected short-term variance and I’m happy with the long-term plan with my investments so none of this really matters. I’m sure I’m not going to remember the stock market blip of mid 2015 in 10 years’ time!

My savings rate fell due to how my annual income is structured each month. But, as in September, my monthly expenses were very well restricted and hence this savings rate will pop up when my companies pay me director dividends in the coming months.

The All New & Improved Savings Challenge!!

And, in September, I have been busy. Really busy!

The 2016 Savings Challenge is almost ready for release and I’ll be in contact with you participants personally via email to discuss it in the coming week. There will be a new (and greatly improved) tracking template, easier ways to submit your results, more focus on goals, better sharing and community, more organised mini-monthly challenges, etc etc.

For anyone who has been following the challenge, but hasn’t yet joined (like Barrie S who had been tracking since Feb but only joined this month), I would recommend that you join the challenge today. Why? Well, for all “existing” participants at the end of October, I don’t ever intend to charge you a penny to stay in the challenge for life.

However, once the new & improved challenge is released, we are going to start to charge a fee for new participants to join the challenge. There will be a discount to join before 01/01/2016, but there will still be a charge if your not an active participant at the end of October 2015. So, get involved! 🙂

Moneystepper Savings Challenge September Results Summary

In August, we noted the following:

- Net Worth result ABOVE goal and Savings Rate result ABOVE goal => 7 people

- Net Worth result ABOVE goal and Savings Rate result BELOW goal => 3 people

- Net Worth result BELOW goal and Savings Rate result ABOVE goal => 2 people

- Net Worth result BELOW goal and Savings Rate result BELOW goal => 4 people

- Not submitted => 19 people

Overall, the average (mean) for everyone who submitted their results in August was:

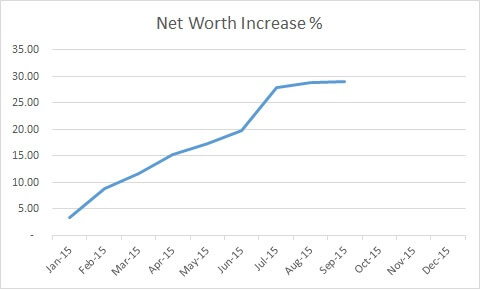

Net worth improvement: 29.0% (August: 28.8%)

Savings rate: 49.1% (August: 52.8%)

A quick update on the net worth increase graph shows that despite the falls in the global markets, that line (the average net worth increase for all active participants) does keep going up (even if it was only by 0.2% on average in September):

Which, I’m pleased to say, means that we continue to achieve the impressive feat of the challenge’s average net worth going up in EVERY SINGLE MONTH.

So, as a whole, keep going everyone – you are doing incredibly well. Don’t panic because of falls in the market, just keeping working hard!

I can see that you have been because even with those global market shakes in September, you’ve kept up that average savings rate, and even managed to increase your average net worth again in the month.

In working on the new and improved challenge, I also noticed a pretty awesome fact. As a group (on average), we’ve actually already surpassed our original net worth goals. The average net worth goal at the start of the challenge for the active participants was 25%. As you can see from the results above, with 3 months still left in the challenge (AND after two months of falling markets), we’ve already achieved a 29% increase!

We’re awesome…! 🙂

So, like every month, now it’s time to get personal…

Moneystepper Savings Challenge September Results Detail

Below you will find the results for everyone with a very brief comment by myself. If you are not happy with the comments, please send me an email and I can change/delete then…

When you make your submissions, the comments you add really help and they are getting better every month. Hopefully, you are finding some value from our personal exchanges resulting from your comments, so please carry on adding them!!

All results are ordered by the net worth YTD comparison in descending order. It is important to note that this doesn’t indicate how well people are doing relative to each other because some people have been more ambitious in their goals that other.

But, we probably shouldn’t care anyway, as that just makes it a game of “keeping up with the Joneses”. Be the best you can be! The end…

| Name | Website | Net Worth Goal (Pro Rata) | Net Worth Sept Result |

Net Worth YTD Comparison | Savings Rate Goal | Savings Rate Sept Result |

Savings Rate YTD Comparison |

| Cath D | 7.5 | 13.2 | +76% | 56 | 56 | +0% | |

| Weenie | Quietly Saving | 18.8 | 23.0 | +23% | 50 | 48 | -4% |

| Philippa M | 18.8 | 22.5 | +20% | 60 | 71 | +18% | |

| Elle M | Couple Money | 22.5 | 26.8 | +19% | 20 | 20 | +0% |

| Pete M | Meaningful Money | 75.0 | 88.6 | +18% | 23 | 22 | -4% |

| Tom B | 22.5 | 24.8 | +10% | 45 | 50 | +11% | |

| Barrie S | 13.5 | 14.7 | +9% | 65 | 77 | +18% | |

| Dominic | Gen Y Finance Guy | 37.5 | 37.1 | -1% | 50 | 44 | -12% |

| Jeany B | 11.3 | 10.8 | -4% | 19 | 35 | -46% | |

| Vawt | Early Retirement Ahead | 28.5 | 26.6 | -8% | 67 | 68 | +2% |

| C | The Single Dollar | 112.5 | 96.2 | -14% | 50 | 50 | +0% |

| Lynx | Location FI | 26.3 | 22.3 | -15% | 60 | 69 | +15% |

| Graham C | 22.5 | 18.7 | -17% | 35 | 26 | -26% | |

| Mr Zombie | Finance Zombie | 37.5 | 28.0 | -25% | 55 | 59 | +7% |

| Nigel W | 9.0 | 6.5 | -28% | 40 | 35 | -13% | |

| Captain Cash | Mr. Captain Cash | 26.3 | 17.3 | -34% | 80 | 72 | -10% |

| Dan T | 4.0 | 2.1 | -54% | 10 | 25 | +150% | |

| Matt S | The Humble Broker | 37.5 | 14.0 | -63% | 25 | 16 | -36% |

Cath D – Cath’s net worth actually increased by a small amount in September, keeping her way, way ahead of her goal. With the savings rate in line with her goal (which has been very consistent), I think it’s time to re-evaluate the net worth goal for Q4 to make sure that Cath keeps on pushing hard for the rest of the year. It’s amazing that Cath has achieved a 13.2% increase in her net worth by September when her original goal for the whole year was 10%. However, it’s really important to keep up the momentum, and changing the goal will do that. I’ll be in touch shortly Cath to discuss what we should change the goal to.

Weenie – Weenie’s net worth fell slightly in the month (from 25.8% to 23%) as she is now saving for a big overseas holiday next year. This brings up two interesting things. Firstly, Weenie is demonstrating the concept of “building up liabilities” that we have previously discussed in the challenge. There’ll be more on that available in the FAQs for the all new challenge which I’ll be emailing out this week. Secondly, Weenie’s comment she left with the submission is really interesting:

“I know big overseas holidays fly in the face of frugality and saving for Financial Independence, but I’m not always going to have the opportunity to go to a country I’ve never been to before (Japan) and do something I’ve never done before (skiing/snowboarding).”

I couldn’t agree more with this. The Savings Challenge isn’t about killing yourself. It’s about concentrating your expenditure on things and experience that you REALLY want to do, that you will remember for years to come, and to make sure that you have the sufficient net worth and savings rate to do that whilst still working towards that longer term financial dream.

And with a net worth increase this year so far of 23% (against an original goal of 20% for the entire year), combined with a YTD savings rate of 48%, Weenie really shouldn’t be worried about going “in the face of frugality” when it comes to having experiences like this which will define her life and future memories.

The key is having the plan, saving up responsibly for the expenditure when it arrives next year and being prepared enough so that you can actually enjoy the experience, safe in the knowledge that it was all part of your masterplan!

Philippa M – Another great month for Philippa. Her original net worth goal at the start of the year was 15% which she was unsure that she could achieve. At the end of Q3, her goal is now up to 25% for the year, and now she has almost surpassed that figure with three months still to come. I again would recommend that another re-evaluation of the goal is put in place for Q4 and a strong push will me a good Christmas in Philippa’s house! 😉

Elle M – Elle added in her comments that her savings rate fell a couple of percent in the month because she spent money on new flooring to make her home more appealing for perspective buyers when she comes to sell the property in a few months. It’s pretty impressive to see that when Moneystepper Savings Challenge participants “spend” money, it isn’t on unnecessary consumer items, but actually on things that will still help the net worth in the long-run. And that attitude is instantly reflected in Elle’s net worth performance. Elle started the year with an objective to achieve a 25% increase in her net worth. At the end of September, Elle’s net worth is already up by 26.8%. Another success story for us to learn from and get inspired by. Good work Elle!

Pete M – Pete is an inspiration, and a great example of what hard work can achieve. For anyone who follows the work of Pete, he hosts the Meaningful Money podcast and joined the challenge after I appeared on his podcast last year to speak about the power of goals and discuss the challenge with his audience. Now, he’s become one of the best performers in the challenge. Check this out: Pete’s original goal for the year for his net worth was a 15% increase, and Pete is a independent financial adviser and so knows more than most how to accurately set his goals. Nine months later, Pete’s net worth has increased by a monumental 88.6% in the year to date so far. Thanks Pete – keep up the hard work in the challenge, in your business and in your podcast – doing the admirable work of sharing financial information in a personable and entertaining way.

Tom B – Tom is beasting it! 🙂 In his comment, he mentioned that he worked overtime almost every weekend in September. Has it paid off? It certainly has. In a month with global markets falling, Tom was able to increase his net worth by 5% in the month, and his savings rate for the year ticked over the 50% mark. It’s only a number, but it sure feels good when you are saving over 50% of your income. Again, Tom’s full annual goal when starting the challenge was to improve his net worth by 20%. His September net worth improvement already stands at 25%. Are you seeing a trend here?! 🙂

Barrie S – Welcome to the challenge Barrie! Barrie sent me a brilliant email earlier in the month explaining why he joined the challenge, and receiving it was truly the highlight of my month. Equally, I found it hugely inspirational and, with his permission, I want to share some of this words with you to help you understand what an amazing journey you are currently on:

“I had been tracking my Net Worth for approximately 5 years but only on an annual basis so the Moneystepper challenge template was a new addition that I never really knew if I would maintain consistently moving forward. How wrong I was, as I can’t wait each month to see the results and read your update on how the group is doing. It has helped me reduce my monthly expenditure and increase my Saving Rate but most of all given me the drive to fully clear my Mortgage, which stood at £52k back in February when I started tracking monthly. Thank you !!!

The reason I have officially decided to join now simply came down to confidence. I woke up and got the FI bug about 5 years ago and have been reading and educating myself ever since. It has took a while to realise that I’m doing a pretty good job on this journey to FI and the impossible dream is achievable to anybody who can wake up and smell the coffee. I’m sure there will be plenty more bumps in the road but nothing that is not manageable with a level head and complete focus on the Goal. I had read about a lot of people such as MMM who had incredible Savings rates on their journey to FI but just took it with a pinch of salt. This changed the more and more I read and finally your monthly update changed all that once and for all. Here were real people doing exactly what I was trying to do but supporting each other along the way. I finally woke up and smelled the coffee to the realisation that I don’t need to do this alone and could have a little fun along the way !!!”

Awesome, awesome stuff Barrie. I can’t wait to have you as part of this challenge and working alongside you on your journey to financial independence for years to come, and I hope that your words inspire other people to take charge of their finances and pay down their mortgages or achieve whatever financial goal that they dreamed of.

Dominic – Dominic has continued his strong progress, with his net worth pretty much in line with his goal, and his net worth falling slightly behind his target to save half of his net income.

Jeany B – Since last month’s update, Jeany has celebrated her son’s wedding and an annual holiday, and hence her savings rate has fallen behind her goal, and this has had a knock on effect on the net worth goal. It’s time to make a push to achieve those year end goals Jeany!

Vawt – Vawt felt another bad month in the markets, but at the same time got his updated retirement statement, meaning that his net worth popped up to 26.3% for the year so far. This also makes sure that Vawt keeps his title as Mr. Consistent – achieving an increased net worth performance in every single month of the challenge so far. I bet that graph looks pretty tasty!! 😉

C – In C’s words herself: “stock market stuff plus a higher-spending late summer.” However, with a savings rate of 50% and a net worth of almost double where she started the year, C shouldn’t be too hard on herself for that higher spending. However, I would recommend giving that planned budget for next month a little bit of a touch up just to get us back on track to push through those last three months. Keep going C!

Lynx – Lynx’s very high savings rate of 69% made sure that despite market falls her net worth still increased for September. She has now fallen very marginally behind her net worth goal. Keep fighting Lynx and you’ll be back above that target goal in no time!

Graham C – See above.

Mr Zombie – I always look forward to Mr Zombie’s fruity comments every month, but this months’ confused me slightly:

“Stock market is sturting, huh? Gotta focus on what you can control, so I’m keeping the in month savings rate above 60%!”

Now, I’ve looked up the word sturting, and can only find a noun sturt:

“In an embryo, an angle equal to two gons. If a mosaic forms in the embryo, the line passes between two organs with a probability, in percent, equal to the number of sturts between them.”

Did that sentence make anyone else’s head want to explode? Anyhow, I digress, and I get the message Mr Z, and agree that it’s a powerful one. In these months when the markets are struggling it’s even more important to focus your attention on what you can control, which is your savings rate. Clearly with a 60% savings rate, Mr Z is doing that.

Nigel W – A man with a plan. Nigel has noted a net worth fall in the past few months, but has identified the reasons why and is focusing on addressing them in October. He’s also moving more money form bonds and cash into equities as a result of the market fall. We advise against trying to “time the market” and it’s difficult to be greedy when others are fearful (mainly due to it being difficult to understand exactly when it is that people are fearful). That said, as an Nigel’s moves are part of an overall long-term well thought out investing plan, it’s always good to see more money going into longer term investments (cash & bonds aren’t “long-term” or “investments” in my vocabulary).

Captain Cash – A 2% increase in his net worth since the previous month means that Mr CC is catching back up with his goal. Keep going for another few months and we may be able to reach that goal by year end. His savings rate also ticked up in the month, moving over 72% again for the first time since April. Good work Mr CC – keep on keeping on!

Matt S – An admission from Matt in his submission comments that he may have let his spending off the leash over the summer months. A savings rate of 36% in April has fallen down to only 16% in September. As a result, his net worth increase, which was at almost 30% in May, has now dropped to 14% – a fair way behind the goal. Time to get focused Matt! I’d recommend having a look through the budget with a fine tooth-comb to identify which categories that spending is showing up in and then take steps to improve it. You’ll thank yourself in the long-term when you have achieved your financial dream!

Conclusion

So, overall, the falling markets are affecting us all. With markets correcting by 10% in the UK and US (and even more in Europe and Asia), we’re doing well as a group to continue that upwards movement in our net worth. As someone said in their comments, “it’s good to know that even when markets go down, my net worth can keep going up”.

As I say, I’ll be in touch early next week to discuss the following topics with you all individually:

- Your Q3 goal re-evaluation

- The new & improved savings challenge tracking template

- The plan for the savings challenge next year and beyond

You’re all amazing, and you all inspire me to keep pushing on my journey to financial independence. I can’t wait to look back in ten years time at all of our results from this year and see how far we’ve all progressed to achieving our financial dreams. Let’s get there together people! 🙂

One last reminder: October will be the last month that new participants can join the challenge completely free for life. As such, if you are a watcher, but not yet a participator, I’d recommend that you don’t wait until 2016 like Barrie S was thinking about, but get involved with the challenge today. I can promise you: you won’t regret it.

You can achieve financial independence, Moneystepper, with that determination. How can I join the challenge?

You can download the tracking template and submit your goals via the following page. Entry is free until the end of October 2015. See you in the challenge! 🙂

The Moneystepper Savings Challenge