Today’s world of investments is complex. There are literally millions of things to invest in. Therefore, you need to understanding which investment suits you personally before concluding on what you should invest in. Its time to take a step back and analyse whether you should investi in property or shares (or cash)…

Property or Shares or Cash – Historical Performance

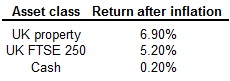

To help you answer the question of whether to invest in property or shares, I want to share with you a very brief, but very striking overview of the performance of major asset classes in the UK over the past 30-50 years:

* Income is rental yield for UK property. This is an estimated figure. For UK FTSE 250, income is the average annual dividend payout.

From this, we can clearly see that UK property has been the best performing asset. This is followed by equities and finally (a long way behind) cash.

Property or Shares or Cash – Adjusting for inflation

However, these figures do not take into account inflation. When we include inflation, we see that the returns fall, but the decision of whether to invest in property or shares is unchanged:

Therefore, by holding cash you essentially will never get richer. Cash is not an investment. So, when answering the question “what should I invest in“, cash is certainly not the winner. It now becomes a fight between whether to invest in property or shares…

Should I Invest In Property or Shares – Impact Over Time

Let’s look at the impact of £1,000 invested today for 40 years in each of the asset classes:

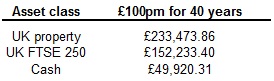

Also, let’s consider £100 per month invested for the next 40 years into the asset classes:

You can see the huge differences that build up over time.

Qualitative Pros And Cons Of Investing In Property Or Shares

However, the benefits and disadvantages of each asset class are not simply quantitative. There are also other pros and cos that we should consider when determining what to invest in:

|

|

Pros |

Cons |

|

UK property |

* Best returns: of the three asset classes, property has historically provided the best returns * Leverage: it is easily possible (in fact normal) to obtain better returns due to leveraging of debt * Tangible: investors often like to own something tangible (bricks & mortar) |

* Illiquid investment: difficult to withdraw the investment if the cash is need * Unreliable income returns: income returns are not fixed and are reliant upon tenants, managing costs * Tax: It is difficult to shield capital gains or income from tax * Risky: in the short-term, market crashes can cause significant pain to investors who are highly leveraged * High effort: managing a property (especially to earn a good income yield) can be a large amount of effort |

|

UK FTSE 250 |

* Ease: investing in the market is easy. Put your funds in a FTSE 250 ETF and forget about it for 20 years. * Tax: investments (up to double the amount available for cash) can be invested tax free in an ISA. This means never having to may capital gains or income tax on the returns. * Liquid: If absolutely required, it is very simple to take your investment out of a large ETF. |

* Unreliable capital returns: returns in any one year in the stock market can be as good at 50% or as poor as -50% |

|

Cash |

* Portable: cash can be easily transferred from one area to another. If you were to move from the UK to Timbuktoo, it is easier to transfer cash than property! * Divisible: given that cash is divisible down to a penny, you can spread your risk. However, you will struggle to find a reasonable property for anything less than £90k in the UK. * Liquid: There is no concern with the availability of your funds when holding cash as an asset * Stability: the worth of cash only ever changes with inflation. Otherwise, it stores it value at the same level at which it was obtained. |

* Poor returns: only one negative for cash, and its a “biggie”. There are no capital returns on cash, and the income is much less than the total returns from other asset classes |

Which leads us nicely to the phrase “cash is king”. Sorry, cash flow may be king in business, but in the world of long-term investing cash is, in fact, definitely NOT king!

You should hold enough cash for your proposed expenses, and as an emergency fund, and that is all. In fact, my thoughts on the format on an emergency fund differs from many others and you might want to check them out here:

Related Article: Emergency Fund – An Alternative View (Moneystepper)

The Real Question: Invest In Property Or Shares – The Conclusion

When looking at the major asset classes (and other than “starting your own business”, these are probably the only investments that 99% of us need to consider), there really isn’t much difference between on the returns when you invest in property or shares.

However, there is a BIG difference when you bring leverage into the equation. To understand how this changes the answer, I would definitely have a listen to the following podcast:

Related Podcast: Session 15 – The Power Of Leveraging (Moneystepper)

However, cash is not an investment – please never treat it as such! If you wish to learn more about these topics, check out our investing and property categories for more articles.

For more on the investment vs savings argument, and specifically on why cash is not an investment, also check out this video from Tim Bennett on iiTV:

If I just have an enough money, I would definitely invest in a property. We can see the huge difference between the three choices, having a property is the best investment.

It is definitely worth considering the qualitative factors though Marie – having been a landlord, it soon becomes clear how much more “passive” stock market investing is compared to investing in property…

Interesting!! I wonder if the figures are same over here? We are absolutely looking seriously at real-estate investing as opposed to investing in the market. I just think we’d do better at it.

I think that there is definitely more scope to beat the average when it comes to real estate investing, especially if you are willing to put the work in.

With stock investing (especially passive investing), its much harder to beat the averages. On the flip side though, it’s also much harder (impossible) to underperform the market if you just invest passively in market tracking ETFs for the long-term.

You just have to work out if you want to take that extra risk (and work) for the extra reward…

I took on a big liability by purchasing my first home but I really do think it’s a good long-term investment. I also think if you can lock in at low rates and leverage debt financing property can be a great investment and produce a solid cash flow. With that being said stocks are a much “easier” investment as you don’t have to worry about keeping up a property, things going wrong, etc.

Do you know if the returns above for property were adjusted for maintenance expenses, property taxes, etc? Just curious, because stuff like that can eat into the returns. There’s usually expenses with investing in the market as well, but I’d think this would be a lower overall percentage unless you were trading often. In any case, cash is definitely not the way to go as you’ve aptly stated. I’m actually a bit surprised there was a positive return for cash after inflation!

The 5% income yield that I used assumes these types of costs. The capital figures come purely from the market price.

This is exactly what I was thinking…

I would also add to the list insurance, interest on the loan, vacancy rates estimates, risk of tenant issues, etc.

Our next purchase is going to be a rental property. I’ve been running the figures, and while we contribute a good amount to our retirement account, a rental property will provide stable income (hopefully) while building equity. It’s just a matter of finding a good property and getting the best price and rates on it. Like stocks, that’s going to determine your return, I suppose.

Interesting post but what your analysis misses is the same thing that most articles of this type misses, namely, the maintenance costs of property and the time/effort involved in maintaining it, finding tenants, etc.

These costs are considerable for property but are zero for stock market shares.

Secondly, shares can be bought with much smaller sums of money than property and can therefore be diversified much easier to reduce investment risk. By a property in the wrong location and you can lose money overnight due to factors beyond your control. From bad neighbours, to new flight path going over your house, say.

Hi Adrian – thanks for the comments.

Regarding the costs or property, etc, this is built into the 5% yield figure.

Concerning the effort involved in property management, I hope that we have highlighted this in the pros and cons in the article above.

Completely agree that diversification is a very key point for both shares and property and you are right in saying that you can invest with smaller amounts in shares than property. Great point.

Thanks again for stopping by!

How about the best of both worlds and consider shares in property related companies?

Benefits include no worries about maintenance, 5%+ yields, the ability to purchase small amounts and you can also place them in a share ISA to avoid any nasty tax.

I’ve invested across Infrastructure, student accommodation, medical facilities, a house builder and property trader. Current average yield 5.9% on dividends with some nice 5-10% capital appreciation on top.

Thanks Thruxie, really appreciate your comment.

It depends what you are investing in. If you are investing in REITs or the equivalent, you are investing more like a property investor, but you also have to pay the wages of the REIT managers which you wouldn’t have to do if you were a property investor yourself. You also have the following problem (and bare with me as this gets a little complex…):

1) Say you buy your property today for £100,000, with an 80% LTV 4% interest-only fixed mortgage. So, you have invested £20,000. Say you obtain net rents of 1% of your property value (equal to the 5% dividends that the property companies provide) and the property market goes up 5% a year. All assumptions which don’t really matter if they are super accurate as we will use the same assumptions in the comparison.

In 10 years time, the property is worth £163,000. You still owe £80,000 on the property. Your investment is still £20,000. Your total income from rents (equal to dividends) is £13,000.

So, from your £20k investment, you have property worth £163,000, debts of £80,000 and income to date of £13,000. This gives us a net position (property worth – debt + income – initial investment) of £73,000 profit.

2) You invest in the property related companies with yield of 5% and 5% capital appreciation (the same as the assumptions above). Note that if these assumptions were to increase, we would have to increase the assumptions in option 1 as they are based on the same underlying asset (i.e. the property market).

£20k invested over 10 years would be worth £33,000 and total dividend payouts in that period would be worth £13,000.

Therefore, our direct comparison after 10 years would leave us at a net position (share value after 10 years + income – initial investment) of £26,000.

Therefore, by directly investing in property, we have almost three times as much profit in ten years.

Say you disagree with the assumptions, and the best we can do in our own investments in scenario 1 is to break even on our net rents. In this scenario, we would still have a profit of £60,000 (still more than double the property company investment scenario).

It is this power of leveraging in your own property portfolio (which does come with a little added risk) which makes it much more appealing over the long-term than investing in property related companies.

Alternatively, if you are investing in property companies as an equivalent to shares, then this is simply investing in one single sector, which is riskier from a diversification perspective and long-term gains in property and construction do not significantly exceed the overall market.

I hope all that makes sense as I do tend to ramble with these things…! 😉

Thanks for your reply Moneystepper that makes perfect sense. As you mention if you can use leverage then it’s buy your own property every time. Obviously ones age will have a factor as well as having a stable income to pay off the mortgage.

In my case I’m unwilling to take on debt as I’m 52 paid off my mortgage and hoping to retire by 55 and live off the income. I still think property shares have a place in a portfolio, yes you have to pay for management costs but on the plus side their scale gives them access to cheap finance/leverage and less worry about finding tenants maintenance etc. One can also reinvest smaller amounts through dividends or regular savings for a nice compounding effect.

Obviously all of the above comes with the warning that all investments can lose value in the short term but over time a mixed asset portfolio should reward. Personally I hold 4 main assets, higher yielding shares, property, gold and bonds but I guess I’m getting off topic a bit so I’ll say no more other than If I could go back in time and advise a young me I’d say get a mortgage as soon as possible but also drip feed money into the stock market on a regular basis.

Cheers!

Warning: The numbers for the gains of property vs shares are from different start dates, I am not sure why the author would not use the same start date… unless they wanted to fudge the results.

I found this infographic on the same topic really clear and helpful:

Investing in shares vs property

Why would we have any desire to fudge the results? The returns start from different start dates as both sets of data use the longest term information readily available.

However, regarding the linked infographic, I notice that its heavily biased towards shares, and is created by wallstreet.st…. Hmmm….!

‘Invest’ in both. Ancient Talmud text advocated holding a third each in Land, Commerce and Reserves. Buy your own home and you avoid having to pay rent. Own some stocks, hold some gold. Whilst gold might on a one for one comparison lag both stocks and ‘land’ its purchase power of stocks/land varies enormously over time and periodic re-balancing can provide ‘trading’ benefits that compare to stock dividends (from natural add-low/reduce-high ‘trading’ that arises out of re-balancing).

I find a 5% net yield a little unrealistic especially for an ‘average’ measure. Ditto some of the comments above regarding the need to take into account agency fees, void periods, repairs, service charges etc with property. As someone else mentioned, maybe the best solution is to own both!