With the Bank of England interest rate at an all-time low of 0.5 per cent, it no longer makes financial sense to keep long-term savings in traditional savings accounts. They have always struggled to outperform inflation meaning that you could be losing money in the long-term.

Related Article: What Should I Invest In? (Moneystepper)

Similarly, if you’ve recently come into money be it through a work bonus, surprise inheritance, redundancy pay out or such like, making the most of this lump sum is crucial to your financial wellbeing in the future.

While investing in stocks, shares and funds is often considered a somewhat risky strategy – as your money can go up as well as down – it has historically yielded excellent returns. The trick is to make sensible financial decisions and to think things through carefully before making your move. With this in mind, here are a few great investment tips to consider and a review of some of the investment services on the market today.

Your attitude to risk

When it comes to investing, your risk appetite will be one of the most important factors to consider.

For most, we recommend that you avoid investing in individual shares because the risk and volatility is much higher, proper diversification is difficult to achieve, you suffer high trading costs and it is unlikely that you will be able to outperform the overall market.

Related Article: Why Passive Investing Is Better Than Active Investing

If the thought of losing any amount of money is too much to bare you will need to amend your investment portfolio accordingly and the stock market may not be the right place for you.

But for the rest of us who are happy to ride the short term volatility to achieve longer term results, the stock market can be a very useful (and easy) tool.

It’s important to do what you feel comfortable with otherwise investing could give you more than one sleepless night.

How long you want to invest for?

If you’re saving for a house deposit and are looking to buy in one or two years, it’s unlikely that the stock market is the right investment for you. It’s often said that the key to successful investing is time in the market rather than timing the market.

Related Article: Timing The Market – Is It Possible (Moneystepper)

Rates and returns can fluctuate so if you’re in it for the long haul you may have more chance of benefitting from reliable returns and riding out any dips in the financial markets. If you have short-term savings goals, sticking to a cash ISA or something similar might be more appropriate.

Decide how hands-on you want to be

Enjoy making personal investment decisions? Then a hands-on approach might be best you. Alternatively, you might want someone to do all the grafting for you and make your money work hard without lifting a finger.

If you are willing to manually rebalance your share portfolio, Moneystepper would suggest that low-cost index tracking funds or ETFs, bought for the very long-term through direct online brokers will incur the lowest fees. This is our preferred method and I personally use SVS Securities as my online broker.

However, if you are willing to pay a little extra in fees, there are many online investment management companies that’ll organise your finances for you. Here’s an overview of a couple of them.

Nutmeg

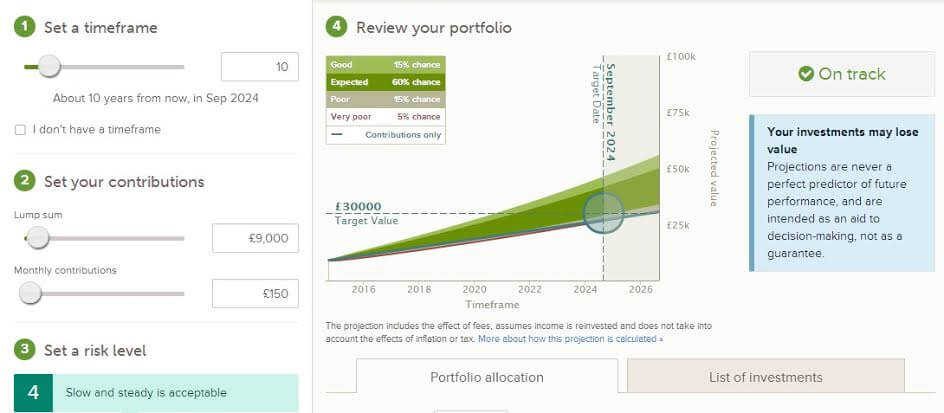

Nutmeg is the ideal investment platform for anyone that wants to invest but has no interest in making the investment decisions themselves.

They’ll simply assess your attitude to risk and from there will build an intelligent, fully-managed investment portfolio for you. Their website is incredibly clean, simple and easy-to-use and you get a team of professional investment managers constantly watching the markets to identify investment opportunities on your behalf. They adjust your portfolio at least monthly for no extra cost, helping to keep your investments on track.

You can set up a stocks and shares ISA with Nutmeg and transfer in cash ISAs and stocks and shares ISAs from other providers. Nutmeg has also just launched a personal pension service.

In exchange for managing your investments, Nutmeg will charge fees of between 0.3% and 1.0% per annum depending on how much you have invested, on top of the underlying fund costs and bid/ask spreads.

It’s important to understand these fees and work out for yourself as an individual whether they are worth paying for the service you receive.

Here’s what some of Nutmeg’s customers have said:

- “It’s much more convenient, much more accessible, and much more transparent.” — Andrew, company president

- “Nutmeg have taken away the burden of managing my money. I feel safe. With Nutmeg, I have an expert investment team.” — Fergus, chartered accountant

- “Nutmeg really called out to me. I felt it could offer a better return on my investment, in a way that suited me.” — Darren, business consultant

Related Article: Customer Testimonials (Nutmeg)

Fidelity

As one of the world’s largest mutual fund and financial services groups in the world, Fidelity appeal to a wide range of customers – those who want to manage their own investment and those who want a full-managed service. They’re a multinational financial services cooperation which offers not only exquisite customer service but a smart, easy-to-use website and plenty of financial insight.

Whilst a huge number of people use their service, they don’t come cheap. Their stocks and shares IRA for example has an ongoing charge of 0.95% (a charge that doesn’t exist with many online broker such as SVS Securities above) and additional “service fees” of up to 0.35%.

Conclusion – Where Should I Invest My Savings Given The Low Savings Rates?

Whilst our personal preference at Moneystepper is to simply invest in low-fee index funds and market tracking ETFs, many people may find value in the support offered by investing services such as Nutmeg or Fidelity. Just make sure that you know what you are paying in fees and that you understand where your money in invested.

You just cleared up my mind on where I should invest my savings. Nutmeg is the top on my list. Thanks Moneystepper.

It’s important to remember that if your savings is short term then it’s best to keep your money in something like a high interest savings account. It really depends on your risk tolerance.