Today we look at 8 questions that every potential house buyer, and especially first time buyers, should ask themselves before they even start looking for the specific house they want to live in.

Today’s generation of first time home owners are absolutely desperate to jump onto the “housing ladder”. Whilst being a homeowner is a great financial decision for people who do it right, it can be a very costly mistakes for anyone who jumps in before they are ready. Therefore, ask yourself the following questions before you buy a home to determine if you are ready!

1. Am I personally ready to buy a house?

Before we do anything, you need to determine the reasons why you are buying a house. A large proportion will simply provide one of the following “reasons” without actually thinking about their personal situation in detail:

“Everyone says you should own your own home”

“Renting is a waste of money”

“I need to get on the housing ladder”

“I want a place of my own”

“It’s about time I bought a house”

“I have enough savings to pay down a deposit”

Now, all of these things may well be true and they all come from a good place. However, the argument between buying a house and renting is only very much favoured towards buying a house if you consider the purchase in the long-term.

The NY times have a handy calculator to show this. By entering some standard variables, taken from the research in our “What Should I Invest In” article, it tells me that if I buy a £150,000 property and I plan to stay in the property for the full 25 years over which I’m paying down a mortgage, then I would need to rent somewhere for less than £520 a month to make the house purchase a bad decision.

All the figures entered into the calculator are done so in “$”, but it’s only the actual number are interested in, so just pretend that the “$” sign is actually a “£”:

A quick search for a 2 bedroom house in Leeds, for example, shows that the rental is more like £650 per month for this type of property in the same area and therefore we would be saving £130 a month by owning rather than renting.

So, clearly this is a good financial decision to buy the house IN THE LONG TERM.

But, what about if we are not personally ready to buy a house? Perhaps, we are young and we still have aspirations of travelling the world. Maybe we’re only planning to live in a certain area for a small amount of time. Maybe, we’re getting married soon and looking to start a family and our “jump” onto the housing ladder is a one-bedroom flat in the city centre.

All of this is to say that if there is a likelihood that you may be leaving your new abode in the short term, then buying this house may be a huge mistake.

We can use exactly the same example as above to demonstrate this point. We can see that the graph changes when we alter the variable “How long do you plan to stay”:

You can see that there is a fairly significant spike if you only stay in the house for a short period of time (as buying and selling costs are higher for each year you live in the property).

In our above example, if we only live in the property for 4 years, our breakeven rent climbs to £644pm. At 3 years, it’s an even greater £750pm, now much higher than the actual price of renting our £150k house.

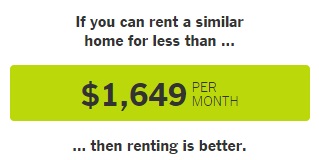

At 2 years, this is £974pm. Finally, if you only stay in the property for one year, the rental equivalent would be a whopping £1,649pm:

Therefore, think about your personal situation and try to work out the likelihood that you’ll be leaving your property in the next few years. If there is a high chance that you might be selling up in the short-term, then you may not be personally ready to own a home and renting may be a better financial option.

Of course, the above doesn’t even begin to consider the stress of moving home and there may be other financial costs which the calculator overlooks (e.g. removal van hire, etc). However, I’d recommend that you head on over to the calculator and put your own figures in to work out whether you’re personally prepared to be buying a house.

Related Article: Is It Better To Buy Or Rent? – The Calculator (NY Times)

2. Am I financially ready to buy a house?

What about your finances? Whilst the above calculator does look a lot at the finances, its benefit comes in showing whether you are personally ready to own a home. Whether you are financially ready is a whole different question.

Unfortunately, there isn’t a simple equation you can use to determine if you are financially ready to buy a home. However, it is an incredibly important question you need to ask yourself before buying a home.

For the majority of people, buying a house will be the biggest financial transaction they make in their lives.

As of December 2014, the average UK house price was around £190k. Let’s imagine that the average person also takes out an 80% LTV mortgage. The first home purchase might therefore consist of:

- An outright purchase (your deposit) of £38k which must be paid in cash

- A loan of £152k taken out in the form of a mortgage

- Additional legal fees, stamp duty, surveyor fees, moving costs, etc of up to £10k

This is huge!

People will (quite rightly) worry about borrowing £50 from a friend or family member, but be much more at ease borrowing £150k in the form of a mortgage.

This monumental numbers mean that it’s absolutely essential that you get your “financial house” in order before you think about buying your actual house.

Some of (but certainly not all of) the indicators that you are not financially ready to own a house are:

- You don’t know your exact financial position (net worth)

- You don’t have a written monthly budget

- You have outstanding interest-bearing debt (medium to high interest)

- You don’t have the required deposit in cash (i.e. you need to borrow from others to find a deposit)

- You’re living pay-cheque to pay-cheque

- If you lost your job tomorrow, you couldn’t live for more than 6 months without income

- You have significant upcoming expenses that aren’t currently built into your budget (children on the way, education costs, etc)

- You haven’t stress-tested your finances to see if they can withstand unexpected changes (see question 9)

Buying a house when you are not ready financially can be one of the worst decisions you can make from a money standpoint, and it’s not as rare as you may think.

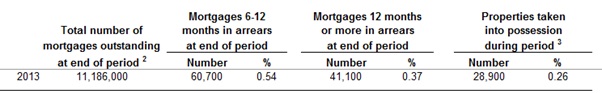

In 2013 (latest data), of the 11.2m mortgages in the UK 60,700 were 6-12 months in arrears, 41,000 more than 12 months in arrears and 28,900 properties were taken into repossession.

That means that 0.26% of houses under mortgage were repossessed in 2013 and a further 0.91% were at risk of being so. And that is when the housing market is rosy.

In 2009, following the economic recession, the number of annual repossessions were almost double that at 48,900.

Don’t become one of these statistics! It’s incredible expensive in the long-run to have your home repossessed due to the impact on your credit file, and the stress that comes with it is almost immeasurable.

Therefore, please make sure that you are “financially ready” before taking the big step of buying a house!

Related Article: Social Consequences Of Mortgage Repossession (JRF)

3. How much of a deposit should I save?

The next question is a tricky one: how much of a deposit should I save?

Firstly, note the wording of the question. It doesn’t say “how much deposit can I afford” or “how much deposit do I need to save”. The problem with both of these alternative wordings is that they suggest that the deposit amount is dictated by you stretching yourself financially as we have just said isn’t a great idea.

When it comes to working out your deposit, your answer will depend on your own risk appetite, current market rates, and a variety of other factors. However, how much you can “afford” for your deposit should very much be an afterthought and a tick box exercise.

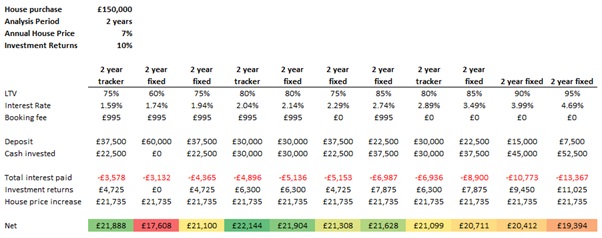

Let’s take a very simple example. Let’s imagine that we are first time buyers, looking to buy a £150k house (which we can afford and we are personally and financially ready for). We’ll assume annual house price increases of 7% and that we can get 10% return on our investments from the stock market.

To get some idea of products out there, let’s throw some figures into the Santander Mortgage Calculator. I’ve entered a 60% LTV here just so that we can get the full range of offers:

Assuming we can afford a 60% LTV, we’ll say that we have £60,000 saved up to put towards a deposit. The following options are therefore available for us:

Assuming we can afford a 60% LTV, we’ll say that we have £60,000 saved up to put towards a deposit. The following options are therefore available for us:

Therefore, you can see that there isn’t a simple answer to what deposit you should be saving or what LTV mortgage you should take.

From this analysis, whilst the 60% LTV mortgage has the lowest interest to be paid over the 2 years, the 80% LTV tracker provides the best results when investment returns and house price increases are taken into account.

Your “right answer” will be based on what variables you include in your analysis. However, just make sure you follow one rule: never let the deposit tail wag the mortgage dog!

Related Article: Saving For A Deposit (Moneystepper)

4. Am I basing my house purchase on what I need, rather than what the bank will lend?

The next common mistake I see with people buying houses and taking out mortgages is that they simply let the bank dictate what they can afford.

Mortgage lenders have common rules and much more complex formulas for determining what they will lend to someone. For instance, many may lend 4 times your annual salary. However, basing your house purchase decision on this alone is crazy!

Imagine we have two families looking to buy a house:

- A couple earning a combined £100,000 a year with no significant savings, but can probably scrape together £20,000 for a deposit. This couple do not intend to have children, live a minimalistic lifestyle (they don’t need much space) and are focussed on saving towards a very enjoyable retirement. Again, using the Santander Calculator, this couple (if they have no other income or outstanding debts), could borrow up to £449,990.

- Another couple with 3 children only earn £30,000 a year, but have savings and investments totalling £800,000. For this family, the same calculator only allows them borrowing of £89,766.

Clearly, this isn’t right for these two couples. The first couple may only require a small house or flat and hence may be able to get somewhere for £100k – £200k depending on location. However, the second couple have a great deal of savings and therefore can clearly service a more expensive mortgage, but may not be allowed to.

Therefore, when thinking about what house to buy, the bank lending amounts should be your last thought.

Firstly, determine what you need in the next 8-10 years from your new home. Base the size, location and condition of your home on what you NEED over this time frame. Then, determine the prices of houses which meet that criteria.

Once you have determined this price range, you should refer to your bank to see if they are willing to lend this amount of money to you (combined with the answers to all the other questions in this article). If so, you can then decide on the deposit you’ll need based on the question above.

What happens if the bank says you can’t afford what you need? Well, you then need to look at your own personal financial situation. The chances are, they are probably right. If the banks aren’t willing to lend to you, it’s probably because you can’t afford the house you are looking for. If this is the case, you may need to rent a little longer, save a little harder and then come back in a year or two to check your updated position.

Once you’ve done your maths, you can check what the banks will lend to you in less than a minute by plugging some figures into Santander’s helpful mortgage calculator below:

Related Article: Santander’s Mortgage Calculators (Santander)

5. Have I compared all available mortgages?

So, you’ve decided what house you want (and that it’s affordable both from the perspective of our financial position and from the banks’ lending criteria). You’ve also decided what your optimal LTV and deposit is for your own personal situation. Now comes the fun part: finding the best mortgage.

There are hundreds, if not thousands, of mortgage products out there, and it’s your job to find the best one for you.

A couple of points to remember. Whilst mortgage comparison sites can be a useful tool, do not rely on them entirely as:

- Many comparison sites overlook certain fees

- Some lenders are not listed on comparison sites

- Qualitative factors are not included (customer service, etc)

- Products are often not comparable (2 year fix vs variable for example)

Therefore, you should really take your time with this question and make sure you find the right mortgage for you. Use comparison sites to get started, but make sure you speak to all available lenders directly (including those who only work through independent mortgage brokers) to ensure that you get the best deal possible.

Related Article: How to secure a mortgage as a first time buyer (Moneystepper)

6. Have I considered all the related costs?

Moving house doesn’t come cheap and this is often one oversight people make in their budgeting process. Whilst everyone thinks about how much money they need to save for their deposit, there are a plethora of other costs that come with moving house:

- Valuation fees

- Surveyors fees

- Stamp duty

- Legal fees

- Estate agents fees

- Removal costs

- Mortgage fees

And that’s just the start. Even if you’ve thought about all that and you’ve saved a sufficient amount to cover the estimates (and probably another 10-20% on top of that to be safe), then comes another bout of ongoing fees and charges which you’ll incur which you might not have done in the past:

- Maintenance and repairs

- Council Tax

- Insurance

- Service Charges

- Ground Rents

- Running Costs

- Furniture

As any homeowner will know: this list goes on and on!

So, before you jump into buying a house, make sure you’ve made accurate estimates of all the related costs, and we would recommend that you have a “safety fund” on top of what you’ve estimated when things go wrong (and they often do…)!

Related Article: 5 Ways To Make Moving House A Little Easier (Moneystepper)

7. Have I prepared a potential future budget for when I am a house owner?

A major part the aforementioned related costs actually come after you’ve become a homeowner and aren’t related to the purchase itself. Its therefore a great idea to complete a “future budget”. Imagine that you have been living in your house for 6 months, and try to create a budget which covers all the on-going regular expenses that you’ll incur as a homeowner.

By doing this accurately, you can compare these costs against your predicted income to ensure that jumping onto that housing ladder is affordable in the future. As we mentioned earlier, getting into financial difficulties once you own a home can be a disaster: both financially and on your mental and physical health.

Therefore, even though making a budget today might seem hard and making a budget for six months in the future might seem nigh on impossible, this is a really important step to take before buying a property.

Related Article: Making a Budget as a Homeowner (The Nest)

8. Have I stress tested my personal financial situation?

Finally, you need to test yourself financially.

What happens if…?

Pose a number of possibilities and determine whether you could still afford to own your home if the worst (or somewhere near the worst) was to happen. Some questions you might want to ask yourself:

- What happens if interest rates rise by 1%, 2%, 5%, etc?

- What would you do if you were to lose your job and regular income for 6 months?

- What happens if you need to move house / location?

- Could you afford the apartment if you were to split up with your partner (if applicable)?

- What happens if all house prices fall by 40%?

- What happens if a nuclear power station is built next door?

The more questions you can ask yourself, the better. It’s not great to think about the worst, but these things happen and it’s always better to be prepared beforehand!

Related Article: The Personal Finance Stress Test (The Telegraph)

Conclusion

Are you comfortable with your answers to all the 8 questions?

If so, great, you are probably ready to buy a house. Good luck!

However, if you are not sure about one or more of your answers, then take a step back. Don’t jump onto the housing ladder just because it’s the “right thing to do”. Think about your personal circumstances and, if you need, take another few months or years to save a little more and make sure you are as ready as you can be for home ownership!

[cunjo layout=”inline_buttons”]

This is a great list for first time buyers. With rates so low I was shocked that the bank was willing to give us a mortgaeg over 6 times my husband’s income. That’s definitely not a smart move for us! After moving in we were surprised with all the little things we needed to buy for yard maintenance, rakes, shovels, extension cords, just a lot of little things that we didn’t consider. But because we had followed a line of questions like yours, it all turned out ok!

These are great questions to consider. It’s crazy how much banks will lend for homes! Often way more than people can actually afford. And calculating the hidden costs like taxes, repairs, furnishings, etc. is huge. Considering your future budget is a great idea, especially for those currently on two incomes who may want to have a spouse stay home with children. I’ve seen too many people forget to count this cost and it stinks when a new mom has to go back to work out of necessity rather than choice.

I remember when I bought my first house (it feels like a lifetime ago)! I jumped straight into getting the mortgage sorted and everything else. However, every question you should ask your self is, do I really have enough money to make my first house a home with added stress? Making your first house a home will definitely take a lot longer than most first time buyers expect!

My favourite thing I have ever done is buy my own house. This list is a very good way of ensuring you have done all the necessary preparation which is very important and should not be undervalued in the house buying process. Good luck to all those buying a house, enjoy it!

How long do those home buyer loans last for for or go for? Both my wife and I will be looking into those loans later today. Mostly because our realtor is her brother is willing to help us out.

Good advice to consider all of the extra costs. List price is far from the only costs involved in buying a new home. Thanks for the tips!

The question that always comes to my mind is about being financially ready to buy a house. It’s what a find somewhat important because of my condition. Now that I have a new job in making a better income, my plan is to find a surveyor that can help me buy a new home.

Buying a property is really a complicated task as it requires lots of knowledge and money in order to purchase a property. I prefer to go with property appraiser rather than dealing on my own.